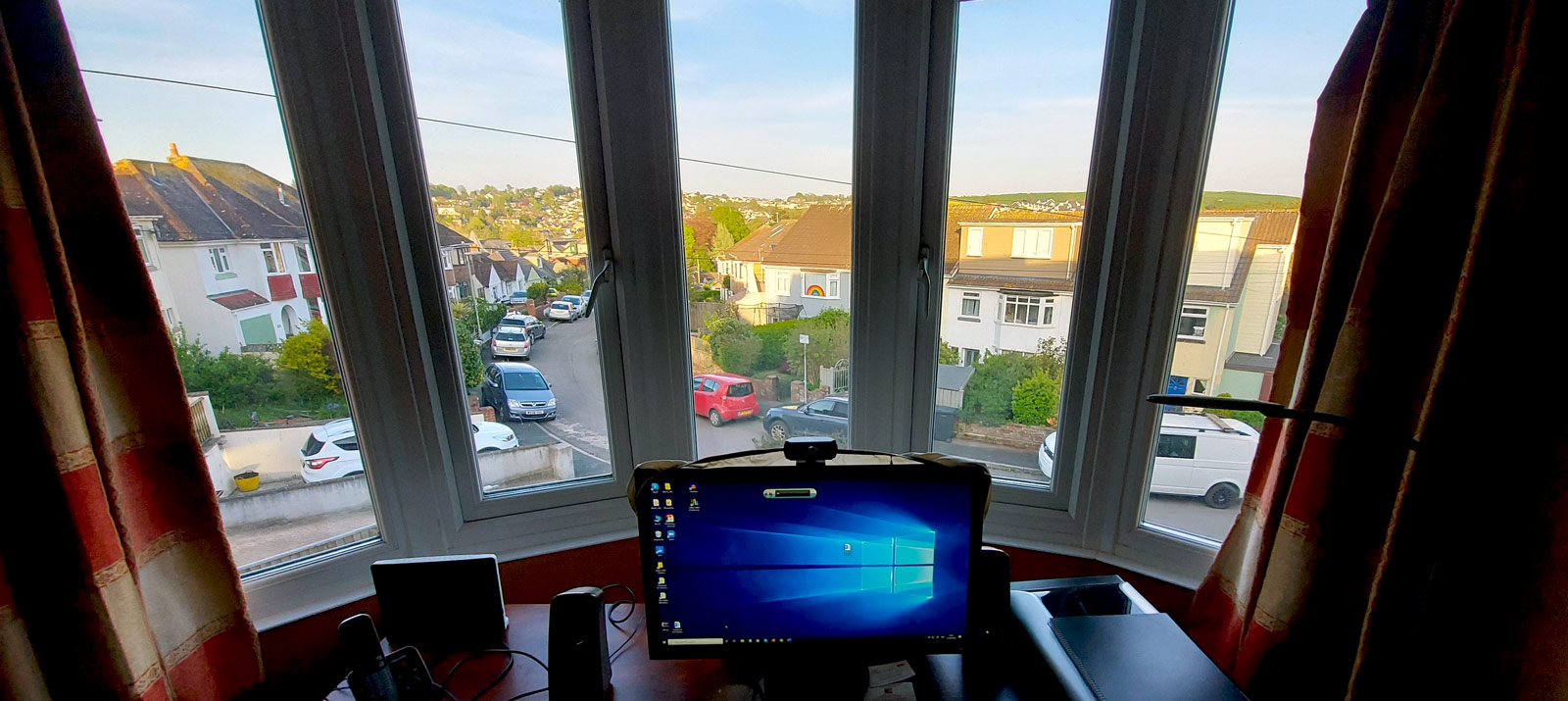

I have the dubious privilege of a mortgage on my terraced house, built in 1938, in Totnes, Devon, England. Twenty five years ago, I received from various dharma friends some £5,000 to put down as a deposit on the house that cost around £25,000.

At the time, the Nat West Bank in Totnes strongly advised me to take out a low cost endowment mortgage and the necessary insurance with Norwich Union Insurance Company. The bank’s financial advisor to customers told me that the mortgage would be fully paid off in May, 2008 and I would also receive bonus of around £3000 in the month of the final payment of the mortgage.

During my five minute dana talk at the end of the DFP meetings in Germany and England, I mentioned that from June 2008 I would not have to transfer £160 monthly from my account to the Nat West bank – as the house would be paid off. I was looking forward to being out of debt to the bank.

Last year, I received notification from the bank that I could expect a shortfall but the bank offered no indication of amount of the shortfall. Naively, I had assumed it would be small. I received notification in April from the bank informing me that I still owed the bank £8812.76 – after 25 years of monthly payments. That leaves more than one third of the original price of the house still to be paid off.

We live in the Matrix. The banks and the insurance companies control our finances squeezing as much as they can through mortgages and obscene bank charges. In the past decade, the banks with the support of insurance companies have indiscriminately lent money to individuals allowing house prices to rocket. These loans have now come to be called “suicide loans” of up to 120% of the value of the house while relying on the buyer alone to state their income.

Many recent buyers were and are in negative equity the moment they signed on the dotted line. The slump in house prices has become a nightmare for those who bought a home in the last year or two. Many can’t afford the mortgage and if they sell their home they face debts due to the drop in value of the property.

CEO’s of banks actively engaged in the credit boom, risk-taking and allowed massive personal debt of customers.

One bank, the Northern Rock Bank lent out 200,000 mortgages in the two years before it went bust. The CEO of Northern Rock received £750.000 following his resignation after the bank collapsed. The board defended the bank’s policy of borrowing large sums of money on the financial markets to lend as mortgages to house buyers. BBC reported that UK taxpayers are now subsidising this single bank in loans and guarantees to other lenders to the tune of about £55bn.

Big banks moved the money gleaned from home buyers around the world in interest-bearing bonds and large scale borrowing. These profit obsessed banks engaging in huge financial deals have lost literally billions of £££s, and now they are determined to recover it from families and individuals struggling to pay for a mortgage. The banks have no interest to protect their customers. Their first priority is maximum profit on return, pursuit of domination of the global market and to encourage bonus crazy schemes for their ambitious managers, no matter how much pain to the customer.

More than 3.5 million mortgage holders in the UK have been informed they face a shortfall at the end of their mortgage of more than £7,000. The banks then set a time limit on customers rightfully claiming they were grossly misled when taking out an endowment mortgage in the 1980’s or 1990’s. I wrote a detailed complaint to the Nat West Bank with photocopies of a 1983 statement from the bank of “sum assured.” The bank didn’t even have the courtesy to reply.

I have now handed over all the information to a legal firm to pursue the matter. If they succeed in getting any redress for myself, they take a cut of 25% plus 17.5% VAT (a government tax). It is a mad system. One has to use one money making business to chase up another. More than 1,000,000 customers have been informed that they left it too late to try to prove they were misled up to 25 years ago. No wonder the banks are slow to reply.

My heart reaches out to all those people who sincerely believed that they would own their home after 25 years. Many face the distress of a retirement living on the state pension while having to keep finding money to pay for the mortgage.

Shame on the banks. Shame on the insurance companies. The proverb is right. The stink of the rotten fish starts at the head.